News

DOJ BOMBSHELL: Letitia James Falsified Residence Status for Better Loan Rates

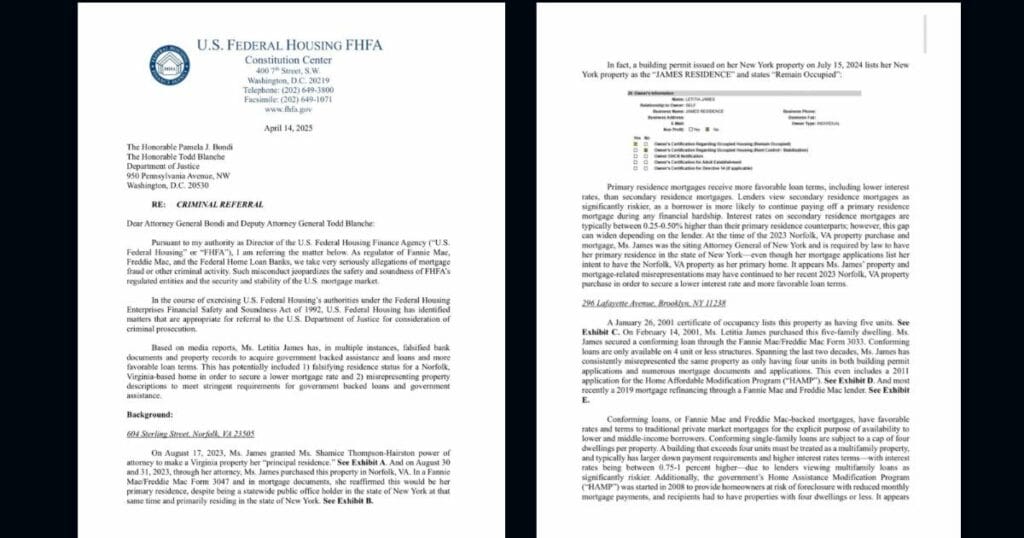

In a striking development, the Trump administration has leveled serious allegations of mortgage fraud against New York Attorney General Letitia James. The Ingraham Angle obtained documents showing the Federal Housing Finance Agency sent a criminal referral to the Department of Justice on April 14, 2025. The referral accuses James of falsifying records to secure favorable loan terms.

The Criminal Referral

FHFA Director Bill Pulte detailed the allegations in a letter to Attorney General Pam Bondi and Deputy Attorney General Todd Blanche. He wrote that “Ms. Letitia James has, in multiple instances, falsified bank documents and property records to acquire government backed assistance and loans and more favorable loan terms.” The referral focuses on two properties: one in Virginia and another in Brooklyn.

EXCLUSIVE: Federal criminal referral documents obtained by Ingraham Angle show NY Attorney General Letitia James allegedly falsified mortgage applications, claiming a Virginia property as her principal residence while serving as New York’s chief legal officer.”

Constitutional law expert Jonathan Turley appeared on the Ingraham Angle to discuss the allegations. He called the situation “perfectly crushing” in its irony. This is a person who prosecuted Trump for everything short of ripping a label off a mattress,” Turley noted.

Virginia Property Misrepresentations

According to the criminal referral, James purchased a property at 604 Sterling Street in Norfolk, VA in August 2023. She reportedly claimed this as her primary residence on mortgage documents. The Fannie Mae/Freddie Mac Form 3047 she signed affirmed this status. This occurred while she held statewide office in New York, where she legally must maintain her primary residence.

The referral explains that primary residence mortgages offer more favorable terms. These include lower interest rates compared to secondary residence mortgages. Turley pointed out that the Justice Department has previously prosecuted similar cases involving false primary residence claims.

Brooklyn Property Unit Count

The second property at issue is located at 296 Lafayette Avenue in Brooklyn, NY. A 2001 certificate of occupancy lists this property as having five units. Despite this, James allegedly “secured a conforming loan through the Fannie Mae/Freddie Mac Form 3033.”

The referral states that “Conforming loans are only available on 4 unit or less structures.” It claims James has misrepresented the property as having only four units for two decades. This includes applications for the Home Affordable Modification Program in 2011 and a mortgage refinancing in 2019.

Legal Standards and Implications

Turley highlighted how James held Trump to strict standards during her cases against him. She insisted Trump was personally responsible for all documents filed in his name. Now similar standards may apply to her own situation.

The criminal referral details why these distinctions matter. “Conforming loans have favorable rates compared to private market mortgages. They exist specifically to help lower and middle-income borrowers.” Properties with more than four units must be treated as multifamily properties. These typically require larger down payments and carry interest rates “between 0.75-1 percent higher.”

When Ingraham Angle reached out for comment, both the Department of Justice and Attorney General James declined to respond to the allegations.

A Role Reversal

The situation creates a remarkable role reversal. James built her reputation pursuing powerful figures like Trump for financial improprieties. Now she faces similar scrutiny. As Turley summarized: “If we applied the Letitia James standard that she created, there’d be little question here.”

Whether these allegations will result in formal charges remains unknown. The political and legal implications could significantly impact the New York Attorney General who positioned herself as a crusader against financial misconduct.